CSE'S STO integration#

14 August 2025 Ver.2.0 ⓒ AllThatSolar. ALL RIGHTS RESERVED – WHITE PAPER

01. Changes in Financial Order : STO and Institutionalization#

1. Changes in the Global Financial Order#

In 2025, the United States formalized the institutionalization of stablecoins and the private digital asset ecosystem through the passage of the 'Virtual Asset 3 Laws' including the GENIUS Act, Clarity Act, and Anti-CBDC Act. This goes beyond just the enactment of laws. Blockchain-based securities (STO) have now established themselves as the link between physical assets and digital finance, with the market for STOs based on real-world assets such as energy, real estate, IP, and venture capital rapidly expanding.

2. Global Market Analysis and Opportunities#

The Rise of the Tokenized Asset Market in the United States#

The U.S. securities market is creating a new trading environment by tokenizing traditional financial products such as stocks, ETFs, and bonds on the blockchain, enabling 24/7 trading.

In particular, certain NASDAQ-listed stocks and S&P500 ETFs have already been issued in tokenized form, allowing international investors to trade without time zone restrictions.

This innovation realizes "global real-time trading," which was not possible in traditional stock trading. If AllThatSolar STO enters the North American market, it can provide a direct synergy for liquidity and an expanded investor base.

Stablecoin-Based Payment Innovation#

Representative tokenized securities exchanges in the United States have adopted stablecoin payments, such as USDT and USDC, completing payments and conversions within an average of 5 minutes after a trade is executed.

This is a revolutionary reduction in speed compared to the traditional T+2 settlement process in conventional finance. If AllThatSolar STO tokens are traded on global exchanges, domestic investors will be able to conduct nearly real-time conversions and settlements in KRW.

Such payment innovations become a key factor in increasing investment turnover and market liquidity.

Strategic Entry of Global Financial Institutions#

Global financial giants such as BNP Paribas, JP Morgan, and Citi are accelerating their market entry through strategic partnerships with tokenized securities platforms.

They are creating liquidity pools specifically for institutional investors, enabling large-scale capital inflows, and are expected to actively participate in asset classes related to ESG and renewable energy in the future.

AllThatSolar plans to directly access this international financial network through its global alliance with Columbia Capital and expand partnerships with major financial institutions in North America and Europe.

Market Growth Outlook#

According to data from Boston Consulting Group, the global tokenized asset market is expected to grow from approximately $310 billion in 2023 to $16 trillion by 2030.

Among these, the renewable energy and ESG-based real asset sector is predicted to experience the highest growth rate, and AllThatSolar's STO issuance strategy perfectly aligns with this market trend.

Therefore, AllThatSolar has the potential to emerge as a key player in the global ESG capital market.

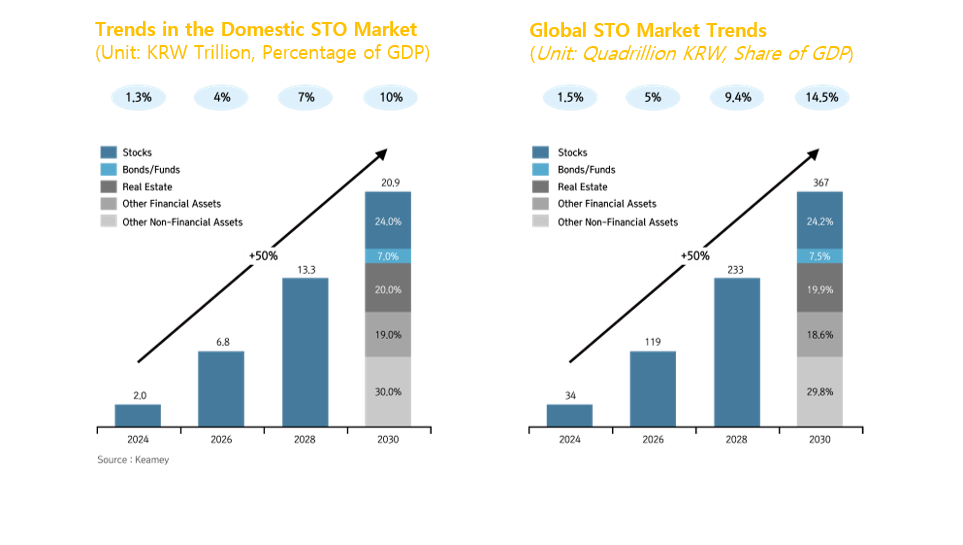

3. STO Market Trends#

4. Domestic Environment#

The South Korean government has declared 2025 as the "Year of Institutionalization of Digital Assets" and is accelerating the development of STO infrastructure through amendments to the Capital Markets Act and Electronic Securities Act. The Korea Securities Depository has opened a testbed platform, and securities firms are speeding up the development of token issuance platforms.

In particular, the domestic market is transitioning from fractional investment models centered on real estate and artworks to real-world asset-based revenue models. Sustainable infrastructure assets, such as solar power plants, are gaining attention as STO underlying assets due to their stability and predictability.

5. Domestic Institutionalization Status#

Push for the Enactment of the Digital Asset 3 Laws#

• The Financial Services Commission is preparing three key legislative proposals (amendments to the Electronic Securities Act, amendments to the Capital Markets Act, and the Digital Asset Basic Act) to institutionalize the issuance and circulation of STOs.

• The issuance structure will be bifurcated into 'security tokens' and 'non-security tokens', each of which will be managed through the electronic securities system and the electronic registration system, respectively.

Direction of the Amendment to the Electronic Securities Act#

• The amendment to the Electronic Securities Act focuses on establishing clearing and custodial structures that ensure the safety of STO transactions and protect investors, moving away from the traditional issuance-centered framework.

Issuance and Distribution Infrastructure Improvement#

• A securities firm-centered issuance system is being established, and a distribution infrastructure pilot project involving KSD (Korea Securities Depository), Koscom, and the Korea Exchange is being prepared. The STO platform pilot testbed will be gradually operated.

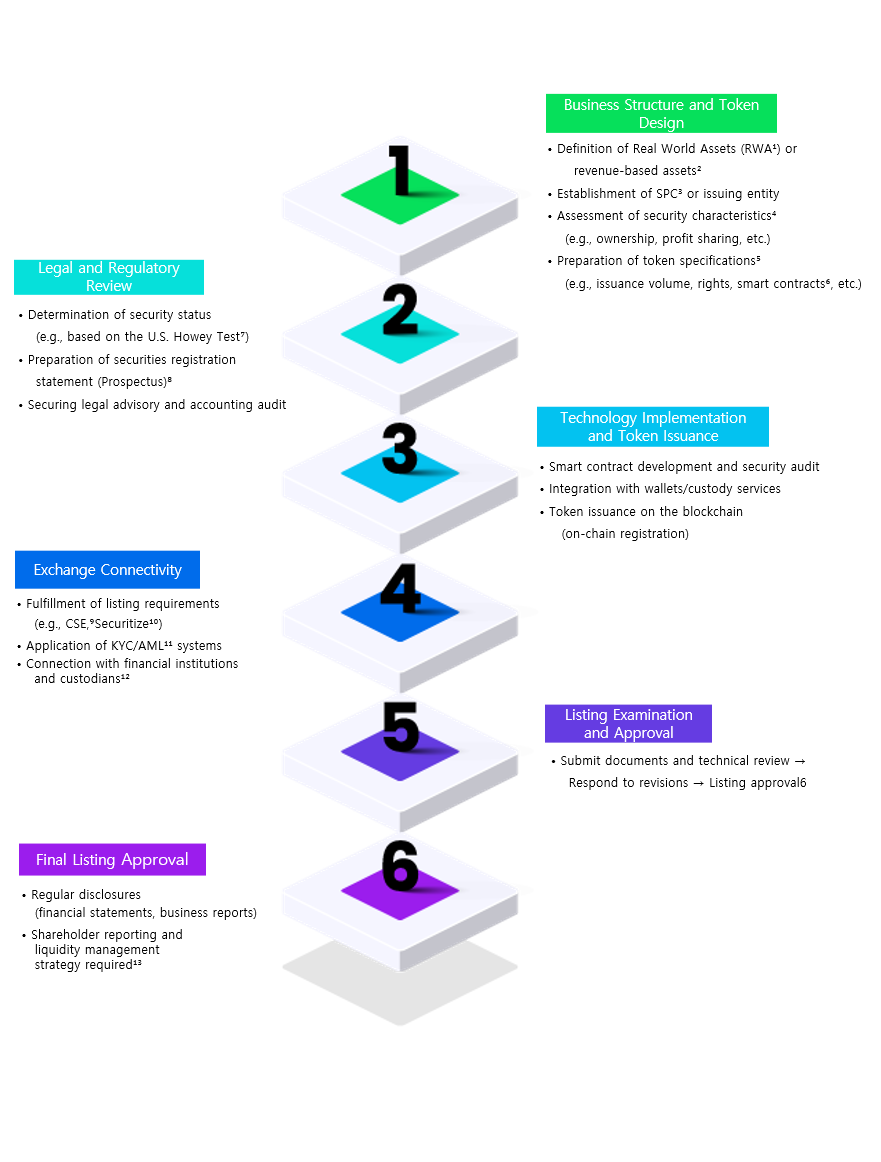

02. Traditional STO CSE Listing Procedure#

Traditional STO CSE Listing Procedure#

Footnotes

-

RWA (Real World Asset): Physical assets that exist outside the blockchain, such as real estate, power plants, and artworks.

-

Income-Based Asset: Assets based on the right to generate income, such as rental income from real estate or electricity sales revenue.

-

SPC (Special Purpose Company): A specialpurpose legal entity established to carry out a specific business, created to separate asset ownership and issuance.

-

Securities Classification Determination: The process of determining whether a token is legally classified as a security (such as equity or profit participation rights).

-

Token Specification: A document that includes the conditions for token issuance, rights structure, and distribution plans.

-

Smart Contract: A blockchain-based contract code that automatically executes when predefined conditions are met.

-

Howey Test: A test based on U.S. SEC standards to determine whether an investment contract qualifies as a security.

-

Prospectus: An investment disclosure document submitted to regulatory authorities during securities issuance, containing asset structure and risks.

-

CSE (Canadian Securities Exchange): A Canadian exchange focused on small to medium-sized innovative companies.

-

Securitize: A leading U.S. digital securities issuance platform, with functions supporting STO listings.

-

KYC/AML System: A system for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance to verify customer identities and prevent money laundering.

-

Custodian: A financial institution responsible for securely holding assets or tokens and facilitating transactions.

-

Liquidity Strategy: Policies or designs aimed at ensuring tokens can be traded smoothly on exchanges or other platforms.

03. Limitations of Existing Assetization Methods#

Limitations of Existing Assetization Methods#

Limitations of Stablecoin Underlying Assets#

• Traditional underlying assets such as the U.S. dollar, gold, and government bonds are not well-suited for the ESG, decentralized finance, and Web3 era due to centralization risks and liquidity concentration issues. Energy STOs, with their sustainable real-world revenue base, smart contract settlement, and potential linkage to ESG and carbon markets, present a strong alternative to address these challenges.

Concerns over Centralization of CBDCs and Digital Currencies#

• The push for CBDCs by central banks conflicts with Web3 principles such as decentralization, personal privacy, and market autonomy. The U.S. Anti-CBDC bill reflects these concerns and has created an institutional recognition of the potential for growth of privately-led, real-world asset-backed stablecoins.

Liquidity and accessibility issues of real-world assets#

• Despite having fixed revenue structures (such as SMP and REC), infrastructure assets like solar power plants remain constrained by non-standardized manual transactions, relationship-based sales, and inefficiencies in financial and legal due diligence. These limitations hinder asset liquidity and investor accessibility, and can be overcome through a digitalized STO infrastructure.

04. Synergy between STO and ESG#

1. Synergy between STO and ESG#

The combination of STO and ESG enables both financial efficiency and the creation of social value.

Eco-friendly Project STO#

-

Example: A solar power plant construction STO → Tracks investment flows on the blockchain, transparently disclosing the use of funds and project progress.

-

Effect: Improved project liquidity and enhanced ESG environmental scores.

Social Enterprise STO#

-

Social-Problem-Solving Enterprises can directly raise funds from global investors.

-

Effect: Creation of social value + expanded financial accessibility.

Governance Improvement STO#

-

Fundraising for corporate internal system improvements and ethical management enhancement projects.

-

Effect: Securing long-term growth potential and investor trust.

2. Overview of the ESG STO Strategy#

AllThatSolar.com is a platform specializing in the brokerage and analysis of domestic solar power plant transactions, providing a one-stop service from asset listing → due diligence → to transaction completion.

This white paper outlines a concrete strategy for issuing Security Tokens (STOs) based on domestic solar power plant corporations using the AllThatSolar infrastructure, and listing them on major global exchanges.

The goal of this strategy is to distribute ESG-certified, real-asset-backed tokens in the global capital markets. To achieve this, DADABROTHERS and Columbia Capital have formed a Global Alliance, jointly handling everything from pre-IPO fundraising to multi-exchange listings and expansion of the investor network.

05. ESG STO Global Listing Strategy#

1. ESG STO Global Listing Strategy#

• Step-by-step execution path:

-

Domestic Pre-STO – Initial investor recruitment and asset verification

-

Luxembourg Euro MTF/LGX Listing – ESG certification, relaxed prospectus requirements

-

Frankfurt eWpG Listing – Expansion of EU mainland investor inflow

-

Canada CSE Listing - Entry into the North American market

*Differentiation: Real-asset-backed, ESG compliant, supported by a Global Alliance

2. Business Structure#

- Power Plant Owner : Listing of assets for sale and document verification

- SPV Establishment: Attribution of power plant assets and structuring of revenue rights

- Token Issuance Module: Based on the ERC-3643 standard, compliant with KYC/AML requirements

- Domestic STO Market : AllThatSolar pre-STO round

- Global Listing : Luxembourg → Frankfurt → CSE

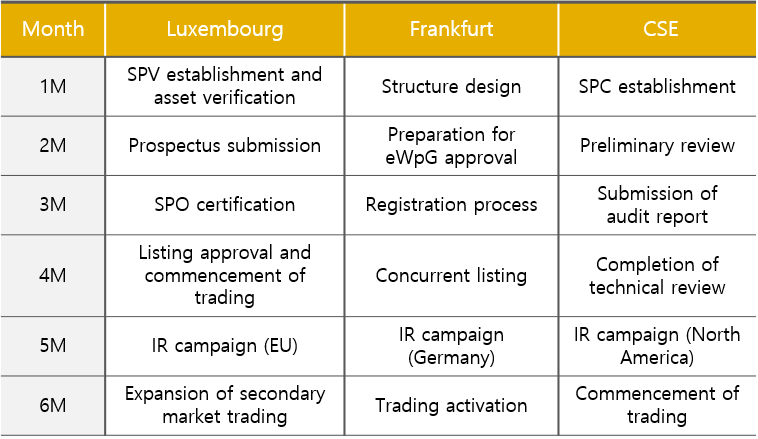

3. Execution Timeline (Example: 6 months)#

06. Strategic Value of a CSE-Based STO Integrated Platform#

Global finance is currently forming a new order amid the digitalization and accelerated securitization of real-world assets. In particular, stablecoins and STOs (Security Token Offerings) have emerged as the two central pillars of the digital asset market, evolving into structures that operate alongside or as alternatives to the traditional financial system.

Notably, the passage of the "Virtual Asset Legislative Package" in the United States in 2025 is regarded as a decisive catalyst for a structural transformation of the global financial market. This legislation has played a pivotal role in accelerating the institutionalization of real-world asset-based digital securities (STOs) and stablecoin structures worldwide, by clarifying regulations on digital assets and establishing the foundation for their integration into the formal financial system.

The energy-based STO structure proposed in this project offers the following strategic advantages:

• Real-World Integration of Finance:#

Establishes a digital securities issuance framework backed by the revenues of solar power plants—such as SMP, REC, and carbon credits—ensuring accounting transparency and asset reliability.

• Digitalization of Energy:#

Converts real-world assets into blockchain-based tokens, creating a digital energy revenue platform that enables global trading and circulation.

• Integration into Regulated Financial Markets:#

Through listing on the CSE, STO-based stablecoins gain institutional and international investor accessibility, while paving the way for the global standardization of real-world asset-based digital securities.

At a time when both credibility and profitability of the underlying assets of stablecoins are in high demand, energy-based STOs—grounded in predictable revenues such as those from solar power—hold the potential to function as a new form of "digital government bond". This structure is regarded as an ideal model that encompasses both expanded financial accessibility and alignment with ESG investment trends.

In conclusion, the establishment of a CSE-based STO integrated platform carries the following significance:

• Strengthening the CSE's position as a hub for global STO issuers

• Expanding into a center for stablecoins and asset digitalization based on real-world assets

• Providing a global STO entry route for Asian companies, including those from

• KoreaRealizing the convergence of real-world asset markets—centered on energy, ESG, and infrastructure—and digital finance

The digital finance innovation triggered by the U.S. Virtual Asset Legislative Package is now being realized through the CSE listing of energy-based STOs, completing the structural integration of finance and energy. This development represents not merely the evolution of a financial product, but a turning point in establishing a new paradigm for the digital asset market—one that achieves the realization of real-economy-based stablecoins and serves as a core strategy for institutionalizing and globally expanding real-world asset STOs.